I wanted a clear answer to a simple question: is my solar system paying off? So I pulled real data from my Duke Energy bills and SolarEdge monitoring and ran the numbers.

Below is a plain-English breakdown of the system, the numbers, and the ROI.

The System

- Installed: June 7, 2021

- System size: 8.16 kWp

- Inverter: SolarEdge SE7600H

- Optimizers: 24 × P401

What I Paid

- Total system price: $23,223

- Loan terms: 1.49% for 20 years

- Estimated payment: $122.32/mo

- Federal tax credit claimed: $6,500

So my net cost after the tax credit is:

- $16,723 (using contract price)

Net Metering Assumption

I reviewed the last year of my Duke Energy Progress bills and came up with some asnwers. Exports are netted 1:1 at the retail rate within each billing period.

Would a battery help? Short answer: no — not right now. Because Duke’s 1:1 net metering already gives me full retail value for exports within the billing period, so a battery doesn’t add much financial benefit. It could add backup power, but for ROI it’s hard to justify. The only scenario where that changes is if Duke moves to time‑of‑use rates or reduces export credits. Under TOU, a battery could help by shifting solar into expensive evening hours — but until that happens, net metering does the same job for free.

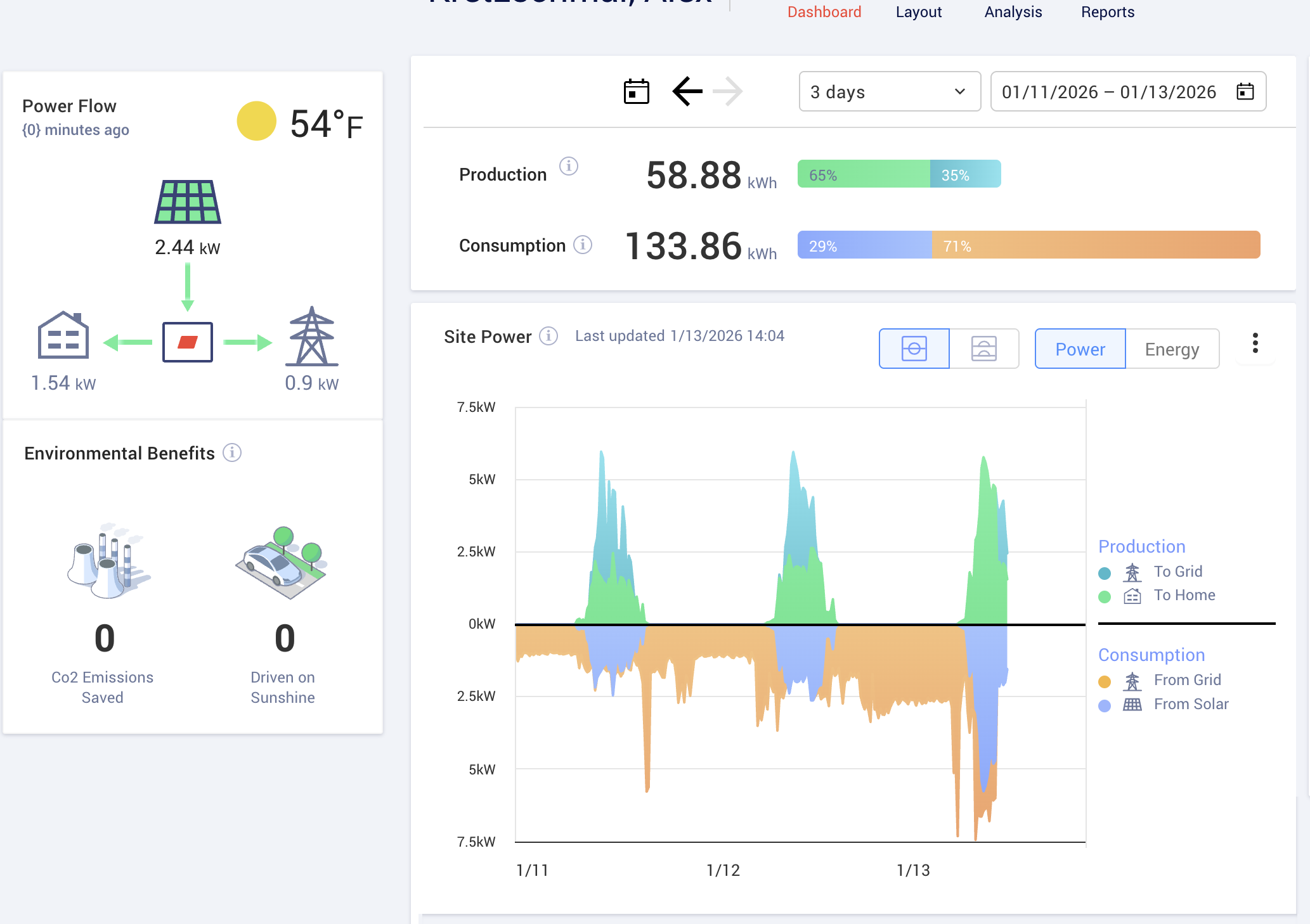

2025 Snapshot (Usage + Production)

From Duke Energy bills (12 unique 2025 bills) and SolarEdge:

- Grid import (Energy Used): 15,858 kWh

- Grid export (Energy Delivered): 2,409 kWh

- Net billed usage: 13,449 kWh

- SolarEdge production: 6,663 kWh

- Blended rate (all charges): ~$0.163/kWh

Important note:

In Jan–Mar 2025 the inverter stopped producing for about 10 weeks. I didn’t notice right away because the Wi‑Fi monitoring was throwing false positives. I’ve now hard-wired the inverter to fix that. It turns out a simple reboot was all that was needed, but it was still frustrating to lose ~2.5 months of production.

Annual Savings Estimate (Year by Year)

Using the 2025 blended Duke rate ($0.163/kWh) applied to SolarEdge production:

| Year | Solar production (kWh) | Estimated savings ($) |

|---|---|---|

| 2021 | 4,565 | 744.55 |

| 2022 | 7,495 | 1,222.40 |

| 2023 | 8,042 | 1,311.71 |

| 2024 | 6,833 | 1,114.41 |

| 2025 | 6,663 | 1,086.70 |

ROI and Payback

Simple payback (no inflation or escalation):

- Net cost: $16,723

- Payback: ~15.4 years

- ROI: ~6.5%/yr

2025 Monthly Detail (From Bills)

| Bill date | Billing period | Import (kWh) | Export (kWh) | Net billed (kWh) | Charges ($) |

|---|---|---|---|---|---|

| Jan 27, 2025 | Dec 21–Jan 23 | 1,578 | 157 | 1,421 | 220.07 |

| Feb 26, 2025 | Jan 24–Feb 24 | 1,554 | 99 | 1,455 | 224.98 |

| Mar 26, 2025 | Feb 25–Mar 24 | 1,276 | 0 | 1,276 | 200.99 |

| Apr 25, 2025 | Mar 25–Apr 23 | 1,465 | 115 | 1,350 | 213.47 |

| May 27, 2025 | Apr 24–May 22 | 1,175 | 347 | 828 | 143.30 |

| Jun 25, 2025 | May 23–Jun 23 | 1,353 | 287 | 1,066 | 178.22 |

| Jul 28, 2025 | Jun 24–Jul 24 | 2,038 | 99 | 1,939 | 305.59 |

| Aug 26, 2025 | Jul 25–Aug 22 | 1,598 | 128 | 1,470 | 236.77 |

| Sep 25, 2025 | Aug 23–Sep 23 | 1,276 | 315 | 961 | 162.29 |

| Oct 28, 2025 | Sep 24–Oct 24 | 886 | 363 | 523 | 100.38 |

| Nov 24, 2025 | Oct 25–Nov 21 | 680 | 366 | 314 | 70.08 |

| Dec 26, 2025 | Nov 22–Dec 22 | 979 | 133 | 846 | 152.02 |

Chart: Estimated Solar Production vs Net Billed (2025)

This chart uses bill data plus a simple self-consumption ratio to estimate monthly solar production. It is directional, not exact, and will not perfectly match the annual SolarEdge total.

Jan | P:############ (587) B:---------------------------- (1421)

Feb | P:########## (523) B:----------------------------- (1455)

Mar | P:####### (348) B:-------------------------- (1276)

Apr | P:########## (515) B:--------------------------- (1350)

May | P:############# (668) B:----------------- (828)

Jun | P:############# (656) B:--------------------- (1066)

Jul | P:############# (655) B:--------------------------------------- (1939)

Aug | P:########### (564) B:----------------------------- (1470)

Sep | P:############# (663) B:------------------- (961)

Oct | P:############ (605) B:---------- (523)

Nov | P:########### (551) B:------ (314)

Dec | P:######## (400) B:----------------- (846)

The Takeaway

Based on real 2025 billing data and SolarEdge production, the system is on track for a 15 year payback and a ~6% simple ROI after the federal tax credit. That’s not as good as I'd hoped honestly. But, it’s a solid, predictable savings — and likely improves as electricity rates rise.